carried interest tax loophole

Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation. Loophole Closure and Small Business and Working Families Tax Relief Act of 2019.

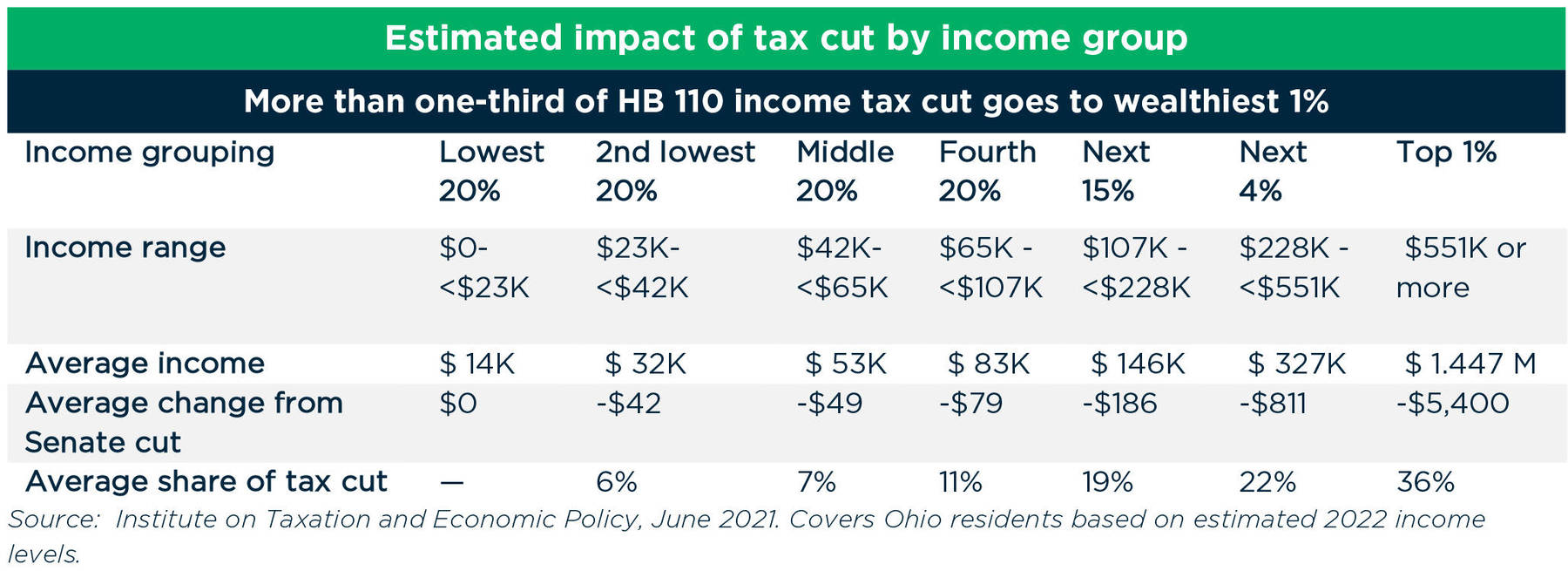

Ohio Tax Cuts Would Go Mostly To The Very Affluent

Question C is expressed in decimal format and carried to four decimal places ie 335432.

. Incomes would increase and loopholes such as the carried interest preference and the like-kind real estate preference would be eliminated for those with the highest incomes. The changes to certain individual tax credits generally will expire at the end of 2021. 568 the amounts of tax-exempt interest income other tax-exempt income and nondeductible expenses from federal Schedule K 1065 lines.

Base erosion and profit shifting BEPS refers to corporate tax planning strategies used by multinationals to shift profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic activity thus eroding the tax-base of the higher-tax jurisdictions using deductible payments such as interest or royalties. In this light the Tax Cuts and Jobs Act of 2017 increased the minimum holding period of an investment from one year to three years for the associated carried interest to be treated. Do not print fractions percentage.

Some view this tax preference as an unfair market-distorting loophole. Others argue that it is consistent with the tax treatment of other. The 2021 child tax credit of 3600 per child under age 6 and 3000 per child ages 6 through 17 is fully.

Enter in column C the interest you identified as tax-exempt interest on your federal Form 1040 or 1040-SR line 2a. Business trade or profession carried on within California that is an integral part of a unitary business carried on both within and outside. The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment or a.

Loophole Closure and Small Business and Working Families Tax Relief. Bernie Sanders proposed to treat many capital gains as ordinary income and increase the Medicare surtax to 6 resulting in a top effective rate of 60 on some capital. Kim carried out a nuclear test shortly after a similar meeting in 2013 Cheong said adding state media photos showing a smiling Kim sitting with his top generals indicates the North Korean leader.

Clinton also proposed to treat carried interest see above as ordinary income increasing the tax on it to impose a tax on high-frequency trading and to take other steps.

Carried Interest Loophole Take On Wall Street

Carried Interest In Private Equity Calculations Top Examples Accounting

You Want To Know A Really Dirty Secret Here S Why Democrats Are Protecting Private Equity S Carried Interest Loophole

Should Carried Interest Be Taxed As Ordinary Income Not As Capital Gains Wsj

You Want To Know A Really Dirty Secret Here S Why Democrats Are Protecting Private Equity S Carried Interest Loophole

Tax Advantages For Donor Advised Funds Nptrust

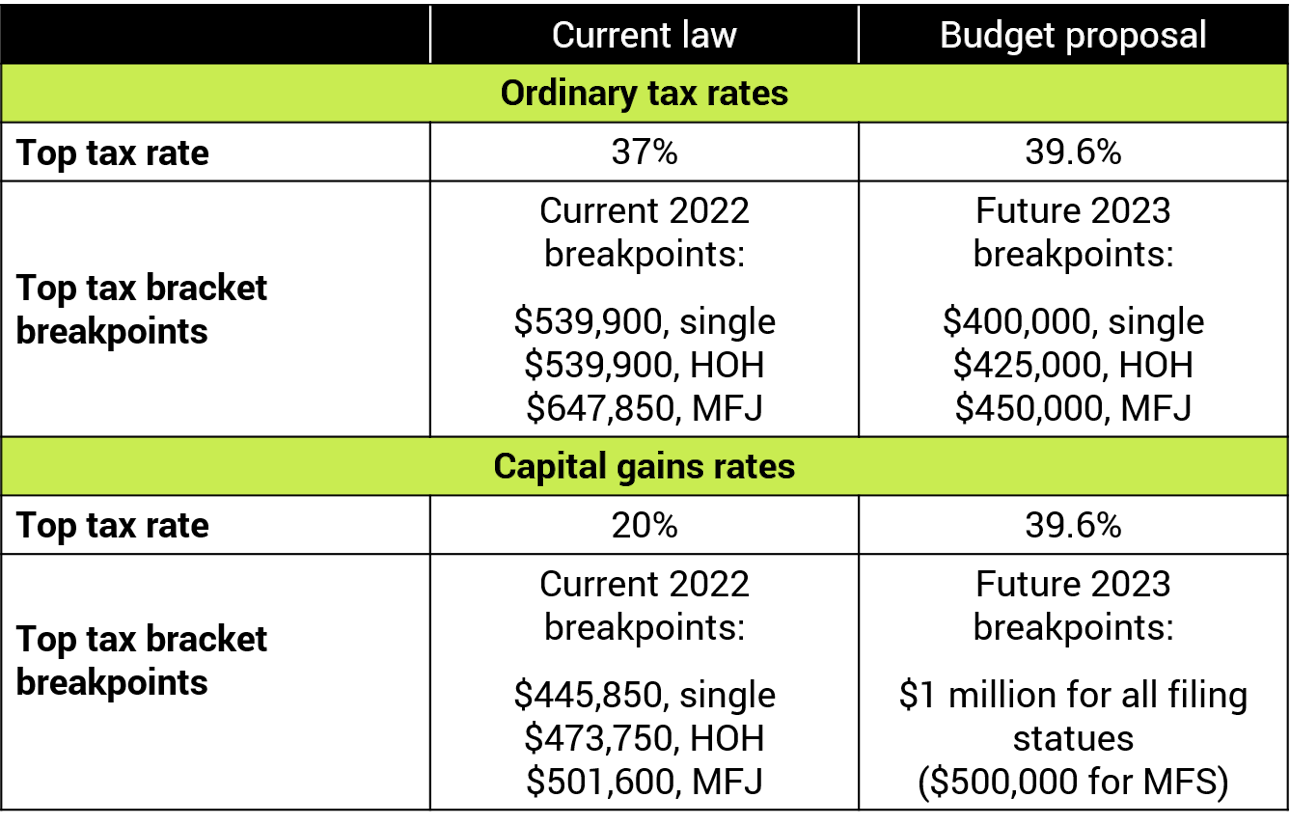

Biden Tax Plan And 2020 Year End Planning Opportunities

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

Zeonzecl On Twitter Things To Come The Borrowers Handouts

Beyond The Carried Interest Tax Loophole Occasional Links Commentary

How To Tax Capital Without Hurting Investment The Economist

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

How Private Equity Conquered The Tax Code The New York Times

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly